| Accumulate energy and move towards the sun. Family offices welcome vast development space |

| data:2024-04-13 14:30:37 | viewed: |

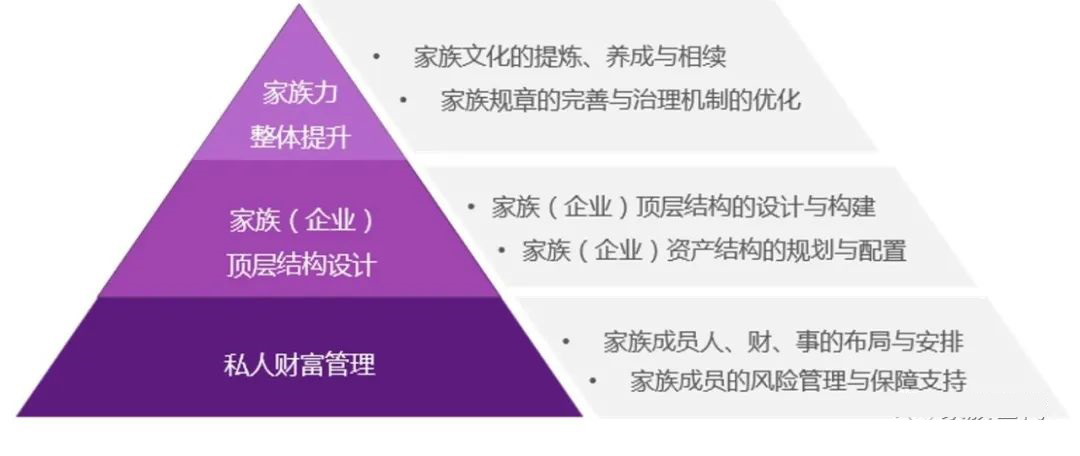

In January 2024, COFCO Trust launched the Houde Family Office brand, aiming to provide comprehensive wealth management planning and value-added services for high net worth households and corporate clients. This is the continuous innovation and development of COFCO Trust's family office business, and also demonstrates its perseverance and determination in serving wealth inheritance. From the establishment of the first real estate family trust, to the launch of family service trusts and exclusive home run brand releases... COFCO Trust has gone through years of accumulation and development. Wu Haibo, General Manager of the Family Office of COFCO Trust, stated in an interview with the China Securities Journal's Collection Investment Guide that currently, the family office has enormous potential in China. With "family wealth inheritance" as the core service content and relying on family trusts as the core tool, it assists in providing asset allocation, children's education and other services. Be a one-stop wealth manager from 0 to 1 It is reported that in March 2020, COFCO Trust established a family office business unit based on the industry advantages and strong strength of the state-owned enterprise COFCO Group. In April 2020, the department was renamed as the Family Office. "At the beginning of business development, everything had to start from scratch and faced numerous difficulties." Recalling the past, Wu Haibo, who has many years of experience in private banking, told reporters that after quickly building a professional and efficient team and building channels for internal and external cooperation in the business, he slowly got on the "right track". When it comes to business development opportunities, Wu Haibo believes that on the one hand, based on the comprehensive transformation of the trust industry, traditional non-standard financing business has shrunk, and "shadow banking" business has been fully restricted. He emphasizes the return to the original trust business, and the family trust and insurance fund trust that the family office did at that time are already mature businesses in the market; On the other hand, with the increasing demand for wealth management, family trusts, insurance fund trusts, and others have gained high recognition and acceptance among high net worth clients. "Coincidentally, COFCO Trust is also seeking new business development paths and models, and is optimistic about the wealth management market, so it 'perfectly fits'," he said. In Wu Haibo's eyes, a family office is a trust legal framework that serves as a professional advisor for high net worth individuals, providing them with comprehensive family management services. COFCO Trust's Houde Family Office is a comprehensive service platform dedicated to launching one-stop wealth management services. In addition to providing professional solutions for wealth inheritance and risk isolation, it can also provide personalized service solutions for children's education, high-end tourism, and other aspects. "Undoubtedly, compared to other trust companies, our home run related business scale is not large and there is still room for improvement. However, the market space is large enough, and with the empowerment of our company's business development, I am full of confidence in the future development of home run business." Wu Haibo admitted, "Taking advantage of the momentum of the dragon and moving towards the sun", which is the declaration released by COFCO Trust's Houde family office brand and its development vision of exploring transformation and seeking new growth points in business. ". Utilize the advantages of trust system from point to surface How to better preserve wealth and effectively inherit it has become the biggest demand of many high net worth clients at present. According to the 2023 Private Wealth Management Report of China Merchants Bank, over 70% of high net worth individuals are preparing for wealth inheritance. In terms of intergenerational inheritance methods, the current high net worth population prefers to purchase insurance and property for their children. In the future, it is expected to expand the establishment of family trusts and enterprise equity arrangements. At present, many licensed financial institutions, including banks, insurance, trusts, and securities firms, have established family offices and carried out family trust business, relying on family trusts as the core tool. Many institutions are conducting family office business, how can the advantages of trust companies be highlighted? How can business drive high-quality development of the company? Wu Haibo gave the answer: "Trust companies have a unique 'inclusiveness'." He said that as the family office of a trust institution, as a trustee, it can effectively gather customers from financial platforms such as banks, securities, funds, and insurance under the services of the trust family office. With trust as the core, it integrates the advantages of products and tools from multiple fields and designs a reasonable structure. Insurance trust is exactly like this. As a family wealth management service tool, it can fully leverage the advantages of trust, achieve goals such as property isolation and wealth inheritance, and achieve personalized distribution of claims. Regarding this, Wu Haibo talked about an impressive insurance trust case. He said, "At that time, the client wanted to achieve wealth protection and inheritance, and wanted to separate large insurance policies and related rights as trust property. Once insurance benefits were paid, the insurance company could directly transfer the funds to the trust company. Based on this demand, we carefully designed, wrote contracts, designed execution processes, etc., and the business model was well implemented. In the next two years, the client also continued to add assets." In addition, he also stated that trust companies have shortcomings in terms of operational capabilities, investment and research capabilities, and customer base expansion in the capital market, and urgently need to deepen cooperation with peers. "For example, securities firms have leading investment and research capabilities, which can empower family office business and collaborate with trust companies to meet customers' wealth management needs," said Wu Haibo. Plan and move to seize industry development opportunities From 0 to 1, from nothing to something, the business of COFCO Trust's family office has steadily developed. According to Wu Haibo, in early 2021, the family office of COFCO Trust assisted family clients in successfully establishing their first real estate family trust, with a scale of nearly 400 million yuan. "Real estate is one of the main assets of many high net worth families, but due to the trust registration system and relevant laws and regulations, holding and managing real estate through family trusts poses some difficulties in practice. The successful implementation of this order is also related to the actual situation of the client, which just avoids some difficulties," he said. Wu Haibo is undoubtedly a pragmatist. Behind the achievements, he and his team worked tirelessly day and night discussing clients, meeting requirements, building structures, and devising solutions, resulting in a single outcome. Wu Haibo said, "The company has given us a lot of support, and we rely on the high-quality platform resources of COFCO Group. We are also more determined and confident in our work." Riding the wind and seizing opportunities is a necessary path for trust companies to deepen their transformation and clarify their differentiated positioning. In Wu Haibo's view, the same goes for developing family office business. The family office is known as the "jewel on the crown of the wealth management industry". Against the backdrop of uncertainty in the financial market, the importance of wealth inheritance is further highlighted, and the wealth management market has enormous market value and development potential. Wu Haibo further added, "At present, the development time of family offices in China is relatively short and still in the early stage. However, high net worth clients have a large volume and strong demand, with broad growth space, but they also face challenges such as versatile talents." Wu Haibo said, "The shortage of key talents with backgrounds in asset management, law, taxation, and overseas family offices is a shortcoming that hinders the development and growth of family offices. In addition, how to combine and use various wealth management tools to meet the deep-seated needs of wealth families, increase service and innovation efforts, is a major issue that needs to be considered for the development of family offices in China." He believes that in the future, domestic family offices should focus more on preserving and increasing wealth, and shift their attention to the inheritance and risk management of family enterprises, accelerating the construction of a professional talent pool. |

| prev:Wealth management focuses on high net worth individuals and insurance next:The 24th Shanghai International Wealth Management Investment |